Transnational Giving Europe

Since July 20, 2009, the Luxembourgish Tax Authorities started granting tax advantages for donations made to beneficiaries located in other member states of the Free Trade European Association. Donors fiscally domiciled in Luxembourg will thus be able to benefit of the tax deductions authorised by law, including for donations made outside the borders.

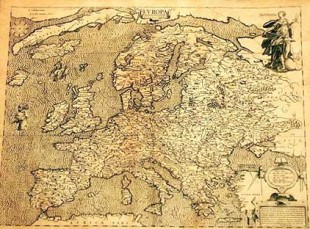

On top of this, the Fondation de Luxembourg is a member of Transnational Giving Europe and promotes cross-border donations to and from 19 countries of the network (Austria, Germany, Belgium, Bulgaria, Croatia, France, Hungary, Italy, Luxembourg, Netherlands, Poland, Portugal, Ireland, Romania, United Kingdom, Slovakia, Slovenia, Spain and Switzerland).

Apart from TGE, cross-border donations are at present not mutually recognised by the EU Member States and donors are not yet entitled to any tax benefits.

In January 2009, the Persche Judgement C-318/07 handed down by the European Court of Justice clarified this issue by ruling against the German tax authorities which had refused to grant tax benefits in connection with a donation made in Portugal by a German tax resident. The donation would have been deductible if the beneficiary organisation had been situated on German territory; consequently, the refusal was regarded as an obstacle to the freedom of movement of capital of which donations to philanthropic causes are an integral part.

However, while this freedom of movement of donations is certainly one of the guiding principles in Europe, the practice is not always so simple because no formal mutual recognition of the concept of “public interest” exists as yet between the EU Member States. That is why national foundations in 19 European countries have set up a network enabling donors in these countries to transfer their donations via the member foundation of TGE in their respective country, to the country of their choice among these 19 states, while still benefiting from the tax advantage in their country of residence. TGE is expanding constantly.

---------------------------------

Are you a US-based donor wishing to support a foundation active under the aegis of Fondation de Luxembourg ?

U.S.-based donors can now make tax deductible contributions to the Friends of the Fondation de Luxembourg through its fund at the King Baudouin Foundation United States (KBFUS). Because KBFUS is a public charity, within the meaning of Sections 501(c)(3) and 509(a)(1) of the IRC, donors may claim the maximum tax benefits allowed by U.S. tax law for their contributions. If you wish to support us, here is how to proceed:

- Gifts by check: Address your check to KBFUS, write “Friends of the Fondation de Luxembourg” in the memo section of the check, and send it to KBFUS, 10 Rockefeller Plaza, 16th Floor, New York, NY 10020

- Gifts by credit card: https://kbfus.networkforgood.com/projects/50550-f-kbfus-funds-fondation-de-luxembourg-lu

- Gifts by wire transfer or to contribute other types of property: Contact KBFUS via email at info@kbfus.org or phone (212) 713-7660.